Hạng mục: Kiến trúc, kết cấu, cơ điện, thiết kế nội thất…. thiết kế BIM, thẩm tra thiết kế xây dựng,…

- Hotline: 0932.89.80.88

- Email: pnconst@outlook.com

- Giờ làm việc: 08:00 - 17:00

LĨNH VỰC CỦA CHÚNG TÔI

THIẾT KẾ XÂY DỰNG

GIÁM SÁT THI CÔNG

Dịch vụ: Giám sát thi công các công trình xây dựng, giám sát lắp đặt hệ thống cơ điện, hệ thống điện nước,…

THI CÔNG XÂY DỰNG

Tổng thầu thi công xây dựng, thi công phần thô, phần hoàn thiện, trang trí nội ngoại thất, lắp đặt hệ thống cơ điện,…

SƠN VÀ HOÁ CHẤT

Phân phối sơn nội thất, ngoài trời, sơn sinh thái,… Các sản phẩm hoá chất ngành xây dựng: keo, chống thấm,…

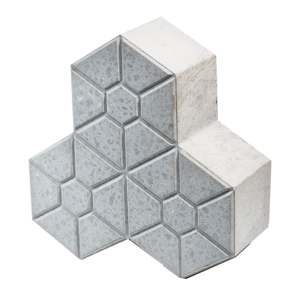

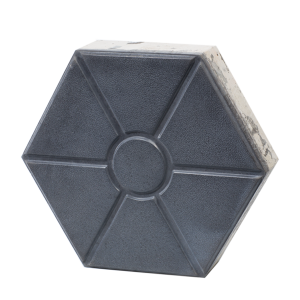

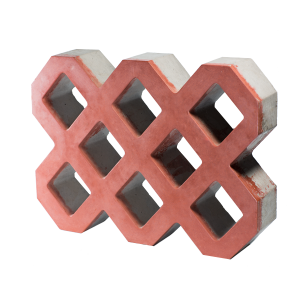

CUNG ỨNG VẬT TƯ

Cung ứng vật tư xây dựng: sắt thép, xi-măng, gạch không nung, gạch men, thiết bị điện nước,…

HỒ SƠ PHÁP LÝ

Dịch vụ xin giấy phép xây dựng, giấy phép. Hồ sơ khảo sát, thiết kế. Hồ sơ thầu, hợp đồng xây dựng,..

DỰ ÁN ĐÃ THỰC HIỆN

SẢN PHẨM MỚI

LÝ DO NÊN CHỌN PNCONST

-

Đa dạng về Sản phẩm & Dịch vụ

-

Lãnh đạo có nhiều năm kinh nghiệm

-

Nhân sự tay nghề chuyên môn cao

-

Tận tâm – Trách nhiệm – Chất lượng

PNConst là đơn vị đi tiên phong trong việc cung cấp giải pháp toàn diện cho ngành xây dựng cả về dịch vụ uy tín lẫn sản phẩm chất lượng cao. Không chỉ thiết kế bản vẽ, thi công xây dựng, sửa chữa các hạng mục từ dân dụng đến công nghiệp mà còn phân phối các dòng sản phẩm vật tư quan trọng trong ngành như: sơn dân dụng – công nghiệp, chống thấm, vật liệu xây dựng,..

PNConst được thành lập, xây dựng và phát triển từ đội ngũ cán bộ công nhân viên nhiều năm kinh nghiệm trong ngành. Đội ngũ ban lãnh đạo của PNConst là tập hợp những thành viên từng giữ nhiều chức vụ quan trọng trong các công ty, tập đoàn xây dựng lớn trong và ngoài nước. Đội ngũ kiến trúc sư, kỹ sư, thợ thi công.. có trình độ chuyên môn cao, kỹ thuật tốt…

PNConst luôn lấy yếu tố con người làm trọng tâm để phát triển và gầy dựng thương hiệu, do vậy chúng tôi chọn lọc, tuyển dụng đầu vào và đào tạo đội ngũ nhân sự của mình chuyên nghiệp, nhiệt huyết và có trình độ chuyên môn vượt trội. Luôn làm việc có trách nhiệm, chuyên tâm cho nghề, cam kết tạo ra những giá trị thiết thực cho cả công ty, khách hàng và xã hội

PNConst chúng tôi tâm niệm rằng: giá trị cốt lõi để phát triển nên thương hiệu, tạo dựng được chỗ đứng vững chắc cho doanh nghiệp không thể không ngừng nâng cao tiêu chuẩn đạo đức trong nghề. Đó chính là sự tận tâm làm việc bằng tất cả trách nhiệm của ban lãnh đạo, tập thể cán bộ nhân viên, đội ngũ thầy thợ có tay nghề,… để tạo giá những công trình chất lượng tốt nhất

Ý KIẾN KHÁCH HÀNG

Khi chọn đơn vị xây dựng cho ngôi nhà của mình, tôi rất hài lòng với dịch vụ thi công xây dựng của PNConst. Tôi cảm thấy tin tưởng, an tâm và rất hài lòng chất lượng khi quyết định lựa chọn PNConst làm đơn vị thực hiện xây dựng căn nhà cấp 4 cho gia đình mình.

Anh Nguyễn Đình An, Q. Gò Vấp

Khi tìm đơn vị thiết kế nội thất cho văn phòng công ty của mình, tôi đã lựa chọn PNConst. Sau khi hoàn thành kết quả thật tuyệt vời, tôi cảm thấy mình đã lựa chọn đúng. PNConst là đơn vị làm việc rất uy tín và chất lượng. Tôi vẫn sẽ tiếp tục lựa chọn PNConst khi có nhu cầu

Chị Ngô Mai Trang, Q. Tân Bình